Purchase Merchandise For Resale Journal Entry . Such purchases are shown on the debit. On 1 january 2016, john traders purchased. Journal entry to record the purchase of merchandise. The purchases account is an income statement account that accumulates the cost of merchandise acquired for resale. The chart in figure 6.10 represents the journal entry requirements based on various merchandising purchase transactions using. Merchandise inventory is specific to desktop computers and is increased (debited) for the value of the computers by $12,000 ($400 × 30). [q1] the entity purchased merchandise and paid $30,000. The journal entry for bought goods for cash is purchase account (debit) and cash account (credit). The purchases account is debited and the cash account is credited. Since the computers were purchased on credit by. The purchase transaction journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry. For example, on october 1, the company abc, which is a merchandising company, purchases $10,000 of. Summary of purchase transaction journal entries.

from www.chegg.com

The purchases account is debited and the cash account is credited. [q1] the entity purchased merchandise and paid $30,000. Such purchases are shown on the debit. The journal entry for bought goods for cash is purchase account (debit) and cash account (credit). On 1 january 2016, john traders purchased. Since the computers were purchased on credit by. The chart in figure 6.10 represents the journal entry requirements based on various merchandising purchase transactions using. For example, on october 1, the company abc, which is a merchandising company, purchases $10,000 of. The purchases account is an income statement account that accumulates the cost of merchandise acquired for resale. Journal entry to record the purchase of merchandise.

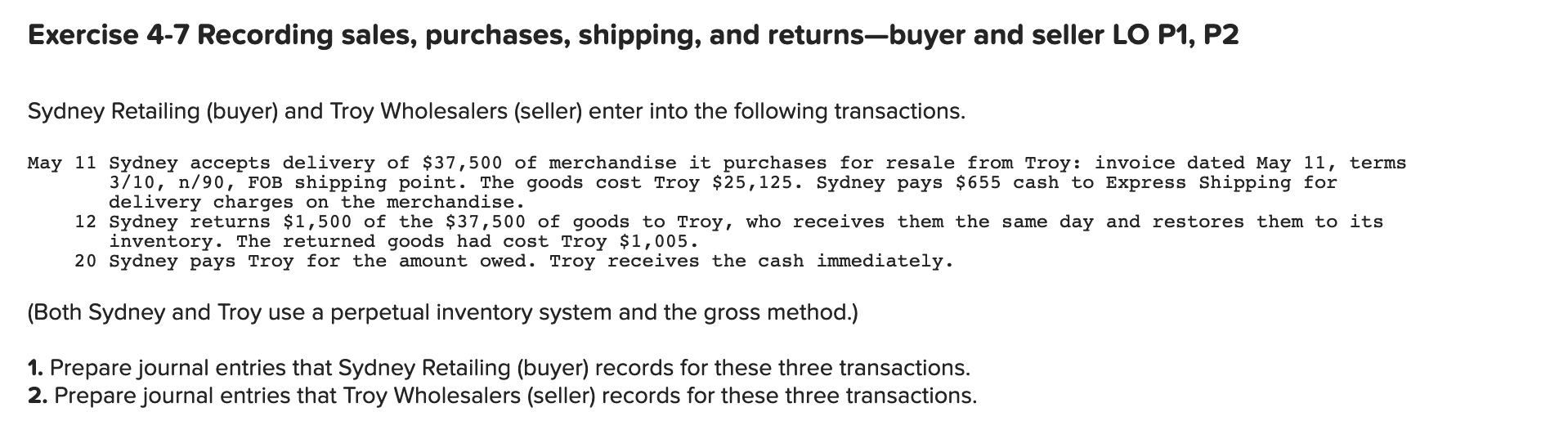

Solved Journal Entry 1 1 ( May 11 ) Sydney accepts delivery

Purchase Merchandise For Resale Journal Entry Journal entry to record the purchase of merchandise. [q1] the entity purchased merchandise and paid $30,000. Merchandise inventory is specific to desktop computers and is increased (debited) for the value of the computers by $12,000 ($400 × 30). For example, on october 1, the company abc, which is a merchandising company, purchases $10,000 of. Such purchases are shown on the debit. The journal entry for bought goods for cash is purchase account (debit) and cash account (credit). The purchases account is debited and the cash account is credited. Summary of purchase transaction journal entries. The purchase transaction journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry. Journal entry to record the purchase of merchandise. On 1 january 2016, john traders purchased. The chart in figure 6.10 represents the journal entry requirements based on various merchandising purchase transactions using. Since the computers were purchased on credit by. The purchases account is an income statement account that accumulates the cost of merchandise acquired for resale.

From www.slideserve.com

PPT Accounting for Merchandising Companies Journal Entries Purchase Merchandise For Resale Journal Entry For example, on october 1, the company abc, which is a merchandising company, purchases $10,000 of. The purchases account is debited and the cash account is credited. The journal entry for bought goods for cash is purchase account (debit) and cash account (credit). Merchandise inventory is specific to desktop computers and is increased (debited) for the value of the computers. Purchase Merchandise For Resale Journal Entry.

From www.vrogue.co

Prepare Journal Entries To Record The Following Merch vrogue.co Purchase Merchandise For Resale Journal Entry Such purchases are shown on the debit. The purchases account is an income statement account that accumulates the cost of merchandise acquired for resale. The purchases account is debited and the cash account is credited. Since the computers were purchased on credit by. The purchase transaction journal entries below act as a quick reference, and set out the most commonly. Purchase Merchandise For Resale Journal Entry.

From www.vrogue.co

Prepare Journal Entries To Record The Following Merch vrogue.co Purchase Merchandise For Resale Journal Entry Merchandise inventory is specific to desktop computers and is increased (debited) for the value of the computers by $12,000 ($400 × 30). Journal entry to record the purchase of merchandise. Since the computers were purchased on credit by. Summary of purchase transaction journal entries. On 1 january 2016, john traders purchased. The purchases account is debited and the cash account. Purchase Merchandise For Resale Journal Entry.

From www.chegg.com

Solved On May 11, Sydney Co. accepts delivery of 40,000 of Purchase Merchandise For Resale Journal Entry On 1 january 2016, john traders purchased. The journal entry for bought goods for cash is purchase account (debit) and cash account (credit). Summary of purchase transaction journal entries. Since the computers were purchased on credit by. Journal entry to record the purchase of merchandise. The purchase transaction journal entries below act as a quick reference, and set out the. Purchase Merchandise For Resale Journal Entry.

From www.slideserve.com

PPT Accounting for Merchandising Companies Journal Entries Purchase Merchandise For Resale Journal Entry Journal entry to record the purchase of merchandise. On 1 january 2016, john traders purchased. For example, on october 1, the company abc, which is a merchandising company, purchases $10,000 of. Since the computers were purchased on credit by. The purchases account is debited and the cash account is credited. Summary of purchase transaction journal entries. The journal entry for. Purchase Merchandise For Resale Journal Entry.

From www.slideserve.com

PPT Accounting for Merchandising Companies Journal Entries Purchase Merchandise For Resale Journal Entry The purchase transaction journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry. On 1 january 2016, john traders purchased. Merchandise inventory is specific to desktop computers and is increased (debited) for the value of the computers by $12,000 ($400 × 30). Since the computers were purchased on. Purchase Merchandise For Resale Journal Entry.

From www.slideserve.com

PPT Accounting for Merchandising Companies Journal Entries Purchase Merchandise For Resale Journal Entry The purchases account is an income statement account that accumulates the cost of merchandise acquired for resale. Since the computers were purchased on credit by. The purchases account is debited and the cash account is credited. The journal entry for bought goods for cash is purchase account (debit) and cash account (credit). Merchandise inventory is specific to desktop computers and. Purchase Merchandise For Resale Journal Entry.

From www.homeworklib.com

Prepare journal entries to record the following merchandising Purchase Merchandise For Resale Journal Entry Merchandise inventory is specific to desktop computers and is increased (debited) for the value of the computers by $12,000 ($400 × 30). The journal entry for bought goods for cash is purchase account (debit) and cash account (credit). For example, on october 1, the company abc, which is a merchandising company, purchases $10,000 of. Summary of purchase transaction journal entries.. Purchase Merchandise For Resale Journal Entry.

From www.slideserve.com

PPT Accounting for Merchandising Companies Journal Entries Purchase Merchandise For Resale Journal Entry [q1] the entity purchased merchandise and paid $30,000. Since the computers were purchased on credit by. The purchases account is an income statement account that accumulates the cost of merchandise acquired for resale. For example, on october 1, the company abc, which is a merchandising company, purchases $10,000 of. The chart in figure 6.10 represents the journal entry requirements based. Purchase Merchandise For Resale Journal Entry.

From www.youtube.com

Merchandising Buyer/Seller Journal Entries YouTube Purchase Merchandise For Resale Journal Entry Such purchases are shown on the debit. The purchase transaction journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry. The purchases account is an income statement account that accumulates the cost of merchandise acquired for resale. The chart in figure 6.10 represents the journal entry requirements based. Purchase Merchandise For Resale Journal Entry.

From www.chegg.com

Solved Sydney Retailing (buyer) and Troy Wholesalers Purchase Merchandise For Resale Journal Entry On 1 january 2016, john traders purchased. For example, on october 1, the company abc, which is a merchandising company, purchases $10,000 of. The chart in figure 6.10 represents the journal entry requirements based on various merchandising purchase transactions using. Such purchases are shown on the debit. The purchases account is an income statement account that accumulates the cost of. Purchase Merchandise For Resale Journal Entry.

From www.homeworklib.com

Sydney Retailing (buyer) and Troy Wholesalers (seller) enter into the Purchase Merchandise For Resale Journal Entry For example, on october 1, the company abc, which is a merchandising company, purchases $10,000 of. The purchases account is debited and the cash account is credited. The journal entry for bought goods for cash is purchase account (debit) and cash account (credit). Merchandise inventory is specific to desktop computers and is increased (debited) for the value of the computers. Purchase Merchandise For Resale Journal Entry.

From www.accountancyknowledge.com

Journal Entry Problems and Solutions Format Examples MCQs Purchase Merchandise For Resale Journal Entry On 1 january 2016, john traders purchased. [q1] the entity purchased merchandise and paid $30,000. The purchase transaction journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry. Such purchases are shown on the debit. For example, on october 1, the company abc, which is a merchandising company,. Purchase Merchandise For Resale Journal Entry.

From www.chegg.com

Solved Journal Entry 1 1 ( May 11 ) Sydney accepts delivery Purchase Merchandise For Resale Journal Entry Summary of purchase transaction journal entries. Journal entry to record the purchase of merchandise. For example, on october 1, the company abc, which is a merchandising company, purchases $10,000 of. The chart in figure 6.10 represents the journal entry requirements based on various merchandising purchase transactions using. The purchases account is debited and the cash account is credited. [q1] the. Purchase Merchandise For Resale Journal Entry.

From www.youtube.com

3 Purchase goods for Cash journal entry YouTube Purchase Merchandise For Resale Journal Entry Journal entry to record the purchase of merchandise. The purchases account is debited and the cash account is credited. Since the computers were purchased on credit by. Merchandise inventory is specific to desktop computers and is increased (debited) for the value of the computers by $12,000 ($400 × 30). Summary of purchase transaction journal entries. [q1] the entity purchased merchandise. Purchase Merchandise For Resale Journal Entry.

From www.chegg.com

Solved On May 11, Sydney Co. accepts delivery of 40,000 of Purchase Merchandise For Resale Journal Entry The journal entry for bought goods for cash is purchase account (debit) and cash account (credit). Summary of purchase transaction journal entries. Since the computers were purchased on credit by. Journal entry to record the purchase of merchandise. For example, on october 1, the company abc, which is a merchandising company, purchases $10,000 of. The purchases account is an income. Purchase Merchandise For Resale Journal Entry.

From www.chegg.com

Solved Prepare journal entries to record each of the Purchase Merchandise For Resale Journal Entry Such purchases are shown on the debit. The chart in figure 6.10 represents the journal entry requirements based on various merchandising purchase transactions using. The purchase transaction journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry. The purchases account is debited and the cash account is credited.. Purchase Merchandise For Resale Journal Entry.

From www.slideserve.com

PPT Accounting for Merchandising Companies Journal Entries Purchase Merchandise For Resale Journal Entry The purchase transaction journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry. The purchases account is debited and the cash account is credited. Since the computers were purchased on credit by. Such purchases are shown on the debit. On 1 january 2016, john traders purchased. The chart. Purchase Merchandise For Resale Journal Entry.